Until these unique events are resolved, please note that many vehicle images cannot be updated to 2022 model year specifications. Furthermore, the global impact of micro-chip shortages is further affecting launch timings and build specifications, including options and accessories. Due to the COVID-19 pandemic, we have been prevented or delayed in the creation of new images of current model year vehicles. Important note on imagery & specifications. In summary, the best way to minimize your finance charge is to avoid cash advances and pay your credit card bills in full each month.© 2022 Jaguar Land Rover North America, LLC Interest on cash advances is charged immediately from the day the money is withdrawn. In other words, there are no interest-free days, and a service fee may apply as well.

You can regain it only if you pay your balance in full for two successive months.Īlso, keep in mind that, in general, the grace period doesn't cover cash advances. It is still advisable to repay your credit in the given billing cycle: any balance carried into the following billing cycle implies losing the grace period privilege. During such an interval, you have time to pay your credit without incurring interest during the grace period. For that, you need to pay your outstanding credit balance in full before the due date so you don't get charged for interest.Ĭredit card issuers offer a so-called grace period, a specific number of days when interest is not charged, often 44 to 55 days.

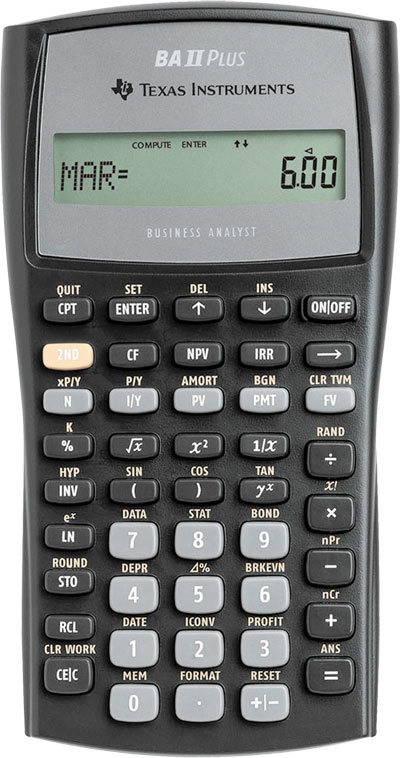

The simplest way to reduce the finance charge is to avoid accruing interest on your balance. To sum up, the finance charge formula is the following:įinance charge = Carried unpaid balance × Annual Percentage Rate (APR) / 365 × Number of Days in Billing Cycle. Say you would like to know the finance charge of a credit card balance of 1,000 dollars with an APR of 18 percent and a billing cycle length of 30 days.Ĭalculate the daily interest rate (advanced mode):ĭaily interest rate = 0.18 / 365 = 0.00049315Ĭalculate the finance charge for a day (advanced mode):ĭaily finance charge = Carried unpaid balance × Daily interest rateĭaily finance charge = 1,000 × 0.00049315 = 0.49315.Ĭalculate the finance charge for a billing cycle:įinance charge = Daily finance charge × Number of Days in Billing Cycle Note that you can apply the present finance charge calculator for most of the above methods (except Daily Balance methods) – you only need to be careful when determining the balance you owe at the beginning of the computation.īy following the below steps, you can quickly estimate the finance charge on your credit card or any other type of financial instrument involving credit. Try to avoid credit card issuers that apply this method since it has the highest finance charge among the ones still in practice. Previous Balance: It uses the final balance of the last billing cycle in the calculation. The Credit CARD Act of 2009 prohibits this practice in the US.Įnding Balance: The finance charge is based on your balance at the end of the current billing cycle. It is the most expensive method of finance charges.

Since purchases are not included in the balance, this method results in the lowest finance charge.ĭouble Billing Cycle: It applies the average daily balance of the current and previous billing cycles. Credit card issuers may apply one of the six different methods to calculate finance charges.Īverage Daily Balance: This is the most common way, based on the average of what you owed each day in the billing cycle.ĭaily Balance: The credit card issuer calculates the finance charge on each day's balance with the daily interest rate.Īdjusted Balance: It subtracts your monthly payment from your opening balance.

0 kommentar(er)

0 kommentar(er)